|

Due to the Upcoming Holiday, Our offices will be closed Friday Sept 1st thru the following Tuesday, September 5th.

0 Comments

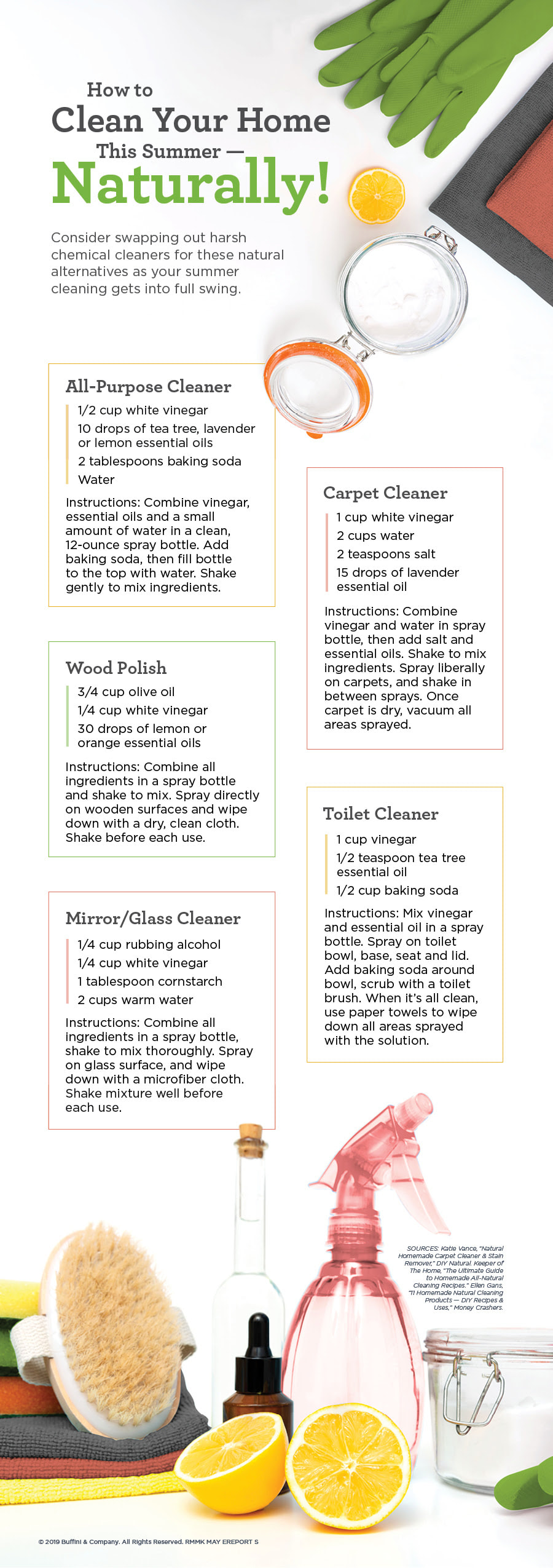

Our friends over at the Harrow team wanted to share some tips on how to clean your home naturally. Also don't forget while you are cleaning your home to take a minute to log your personal items in the house for insurance claims that may happen in the future.

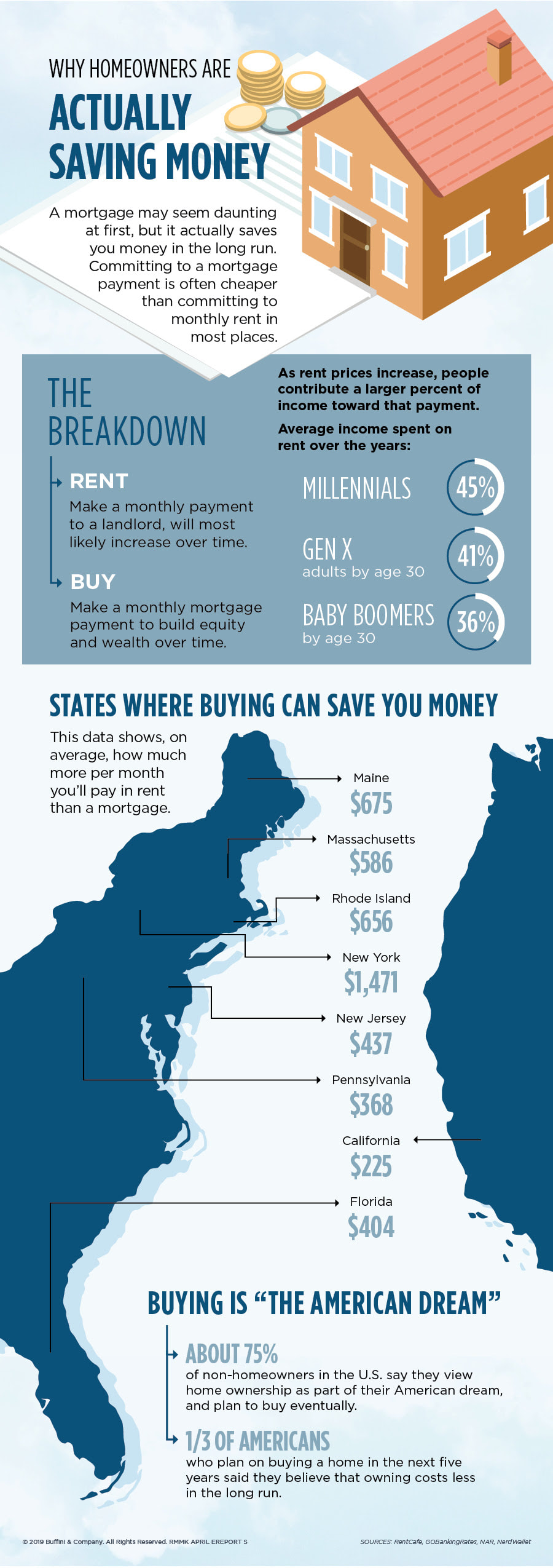

To rent or to buy, that is the question…while a monthly mortgage payment can seem intimidating at first, data show that it can actually save you money in the long run. Take a look at these stats on how much you can save as a homeowner. Remember, as always, I’m here to help with any of your home buying or selling needs and answer any questions you may have about the process!

BY BIG “I” VIRTUAL UNIVERSITY FACULTY

Q: If I pay the insurance premium on behalf of a customer and they don’t pay me back, can I order the carrier to cancel the policy for nonpayment? Response 1: No. Only the insured or the carrier has the right to cancel the policy—not the agent. From the carrier's standpoint, the premium has been paid. Fronting money for an insured is always a bad idea for this very reason. It's not a good business practice. You could try to take legal action. Response 2: That’s the problem with paying your clients' bills. Never do this. To get your money back, you could take the client to small claims court—and then help them find a new agent. Response 3: I think you just learned a hard lesson—never advance payment. The carrier has been paid, so unless you have an agreement, such as those used by premium finance companies, you can’t force the carrier to do anything. Response 4: The carrier should not and will not reimburse you. First of all, you simply gave the insured an unsecured loan. The carrier has been paid, so they will not cancel for nonpayment. If a friend paid for the client and then didn't get reimbursed, could the carrier cancel for nonpayment? No, of course not. This is no different. Second, and more important, you should not be paying premiums for your clients. That’s an example of rebating and is illegal in every state I know of. Response 5: NO! NO! NO! The policy clearly states that the only parties who can cancel the insurance are "you"—the named insured—and "we"—the insurance company. Response 6: Why in the world would you do that? This is not a good business practice. Response 7: The parties involved in an insurance contract are the insurer and the insured. The agent is the middleman. If the insurer has been paid and there are no other valid reasons for cancellation, an agent can’t legitimately order a cancellation. We all like to trust others, but some sort of written agreement involving a down payment would have been the best course of action. Email is an indispensable business tool. But the speed and informality of email can lead to the accidental use of contract-forming language, resulting in unintentional binding agreements. This problem is made worse by statutes that compel courts to be “liberal” in finding contracts formed by emails, even where one party did not mean to be bound. In this environment, companies need to recognize and protect themselves from the very real risk of accidental contracts.

THE LAW RECOGNIZES CONTRACTS FORMED BY EMAIL Contract formation is simple. It requires only an offer, acceptance, mutual consideration and agreement to be bound. Peterson v. Regina (S.D.N.Y. 2013). Importantly, the second element turns on its objective—not subjective—nature. Krumme v. WestPoint Stevens, Inc. (2d Cir. 1998). If an email signals an intent to be bound, even if by careless or accidental language, it will trump any unstated reluctance to form a contract. What matters is whether it is reasonable for the receiving party to believe there is an agreement. Emails can satisfy these requirements. State and federal laws bear this out. The Uniform Electronic Transactions Act of 1999 has been adopted or copied by all 50 states. It provides that a contract “may not be denied legal effect solely because an electronic record was used in its formation,” and it mandates that courts must be “liberal” in upholding contracts formed electronically. In addition, the UETA specifies that courts must engage in an objective analysis of the electronic communications themselves, and not the party’s personal or subjective views. This means that a contract is based on what the person writes, not what she thinks. In 2000, Congress passed the Electronic Signatures in Global and National Commerce Act (E-SIGN). 15 U.S.C. § 7001 (2000). This statute essentially extends the UETA to interstate and foreign commerce. Importantly, E-SIGN preempts state laws imposing “consequences” on parties that do not create “originals” of contracts. Physically signed contracts are thus unnecessary. COURTS ENFORCE ‘ACCIDENTAL’ EMAIL CONTRACTS Courts have embraced their responsibility to be “liberal” in finding contracts in emails, even where they are accidental or unintended. For example, in Williamson v. Bank of New York (N.D. Tex. 2013), (this is a case from Texas!) lawyers exchanged multiple emails to settle a bank’s foreclosure on a home. Responding to a counteroffer from the homeowner’s counsel, the bank’s counsel said it was “doable” but that a week would be needed to prepare a draft agreement. These emails were “signed” with a first name and an automatic signature block. The homeowner fired his lawyer and refused the settlement—which had not yet been put into a formal writing. The court nonetheless ruled that a contract had been formed. The electronic “signatures” sufficed, and the “doable” comment was deemed an acceptance of a counteroffer. The homeowner had to accept a deal he did not want or think was binding, pieced together from several email exchanges. The parties faced a similar outcome in Stevens v. Publicis, S.A. (N.Y. Sup. Ct. 2008). There, an executive sought to renegotiate the terms of an employment agreement through several rounds of emails. The CEO of the company emailed his understanding of the new terms to the executive, who responded, “I accept your proposal.” Before a formal writing could be prepared, however, the executive changed his mind. In the ensuing litigation, the court ruled that the parties had an enforceable contract, as shown by the emailed agreement on terms and the signature blocks. Again, based on email alone, a party was forced to accept a deal he did not think was binding yet. Email contracting has become so commonplace that it requires fairly outlandish circumstances for a court to reject such a contract. For example, in Beastie Boys v. Monster Energy Company (S.D.N.Y. 2013), the music group sued Monster for copyright infringement based on its public use of a Beastie Boys music remix created by a disk jockey called “Z-Trip.” Monster sued Z-Trip for breaching a supposed contract for the use of the remix. Monster based its claim on an email where it asked Z-Trip to “approve” the remix before Monster posted it on the Internet. Z-Trip responded “Dope!” and commented on the remix. Monster said that it believed Z-Trip’s reply was a contractual approval to use the remix. The court ruled that the word “Dope!”—although “memorable”—was “entirely too enigmatic and elliptical to constitute the clear and unambiguous acceptance necessary for contract formation.” It seems unlikely that most contract disputes involving business-to-business emails will require the interpretation of slang. COMPANIES CAN REDUCE THE RISK OF ACCIDENTAL EMAIL CONTRACTS The law addressing contract formation by email reveals several risks for companies. There is no requirement of a formal writing or a physical signature. Loose language—like “doable”—can signal formal, binding acceptance of an offer. Multiple emails will be read together to form a single contract. Last, an objective review of the parties’ emails will trump any unstated reluctance to be bound. These risks add up to the threat of accidental contracts formed by rushed or imprecise emails. Apart from training employees about these risks, there are at least FOUR preventative steps companies can take. First, business emails should state that the company intends to be bound only by a physically executed, formal written agreement that includes all customary provisions. Courts have relied on such language to reject claims of email contracts. In Rubenstein v. Clark & Green Inc. (2d Cir. 2010), one party stated that it needed a “more comprehensive understanding in writing” before it could be bound; and in 1-800-Contacts Inc. v. Weigner (Utah App. 2005), an email offer was “not to be considered legally binding until a physically executed contract” was completed. Such phrases in emails undercut contract formation. Second, business people should be explicit about any hurdles they must clear before closing a deal. They may think it is obvious that an offer is subject to conditions, but their counter party may disagree. So it is a best practice for emails to recite requirements such as management approval or further due diligence. Courts relied on such statements to reject contracts by email in such cases as Enable Commerce v. Standard Register Co. (S.D. Ohio 2011), where “upper management approval” was required, and Tiger Team Technologies Inc. v. Synesi Group Inc. (D. Minn. 2009), where a royalty rate was “yet to be determined.” Third, companies should consider applying automatic disclaimers to business emails, to reinforce that run-of-the-mill emails will not constitute contracts. Such disclaimers might state that “the email ‘signature block’ does not constitute a signed writing for purposes of a binding contract,” or that “the sender of this email is not authorized, and has no intent, to make offers or contracts by email, unless the phrase ‘I hereby so contract and sign’ appears in the text.” The more tailored the disclaimer can be to the email itself, the better. This can be accomplished through the use of merge fields that reflect the sender’s and recipient’s names, the date and even the name of a manager (if any) needed to authorize a contract. The disclaimer can also time-limit any price quotes. Finally, as noted above, companies can implement policies that restrict the use of imprecise language in business emails. Employees should be cautioned to be careful in email, to avoid terms such as “offer” and “accept” unless they really mean it, to avoid unconditional “promises” and to correct misinterpreted emails promptly. These policies can also include random auditing to detect non-compliance and nip problems in the bud before they blossom into litigation. Email has fostered lightning-fast and informal deal making. The law makes clear that inadvertence will not undo an email contract. Adapting to this new business environment through greater message discipline is a prudent way for companies to avoid the serious risk of accidental contracts.

In total, Americans are sitting an average of 13 hours a day and sleeping an average of 8 hours resulting in a sedentary lifestyle of around 21 hours a day. While Americans know about the importance of exercise, only 31 percent go to the gym, and 56 percent devote less than $10 per month to staying active. However, 96 percent would be willing to stand more to improve their health or life expectancy, and 30 percent even responded that they would rather go without coffee for a week to stand.

The survey also found that the vast majority (93 percent) didn't know what "Sitting Disease" is, but 74 percent believe that sitting too much could lead to an early death. The term "Sitting Disease" has been coined by the scientific community and is commonly used when referring to metabolic syndrome and the ill-effects of an overly sedentary lifestyle. Just last month, the American Medical Association adopted a policy recognizing potential risks of prolonged sitting and encouraging employers, employees and others to make available alternatives to sitting. Research is showing links between sedentary lifestyles and diabetes, several types of cancer, obesity and cardiovascular disease, there is a significant opportunity for people to change their behavior in the workplace and for corporations to change their cultures. Standing increases energy, burns extra calories, tones muscles, improves posture, increases blood flow, reduces blood sugar levels and ramps up metabolism. Frequently overlooked, standing more is the simplest, easiest change someone can make. We need to keep our bodies in motion! Introducing!

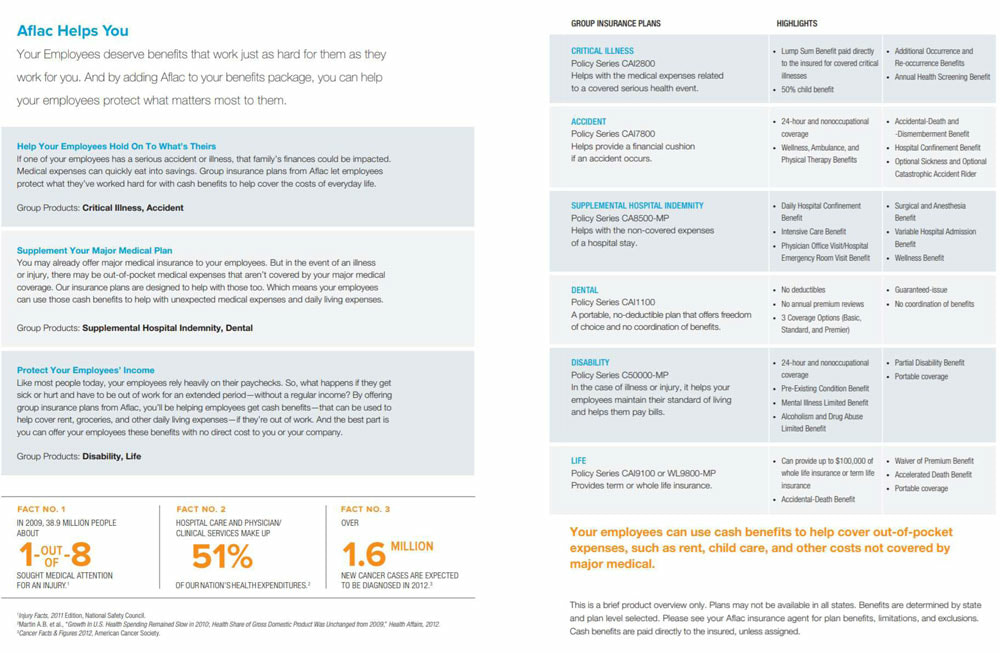

Careen Campbell Allen / Aflac Agent / Benefits Advisory Professional See how Careen and Aflac can help you. It is like being surprised by a lion in the wilderness: Local legislatures have sure been keeping themselves busy lately. It seems like every day we hear about the passage of new state regulations designed to safeguard individuals from workplace harassment, wage & hour disputes, and other matters associated with the employer-employee relationship. Your clients are expected to stay on top of this ever-changing legal landscape. The financial cost of failing to remain in compliance could be devastating.

Get a quote today from Simons Agency and let us protect you! Simons Says. Our clients often ask us to explain the difference between the replacement cost and the market value of a home.

The answer is often much different than people think. Market value can be defined in part as the most probable price that a property should bring in a competitive and open market under all conditions requisite to a fair sale. Replacement cost, otherwise referred to as reconstruction cost, represents an estimate to rebuild your home today, from the ground up, using like kind and quality materials. This includes demolition, debris removal, foundations and a general contractor's profit and overhead commensurate for the project. The cost also includes architectural and engineering fees, plans, permits and building code updates. Replacement cost changes over time and should be monitored regularly. As the home is improved or upgraded, replacement costs are impacted. It is important to keep your agent up to date when you make any modifications. Labor and material costs change at different rates depending on location and other factors. It is important to remain sensitive to these changes so that coverage can be adjusted accordingly. Below are some factors influencing replacement costs. Location Have you ever heard the saying that the three most important factors in real estate are location, location, location? This is because it is often the single biggest factor driving the market value of a home. Location is similarly important when considering replacement cost of your home. It is not uncommon for contractors to charge more when working in an affluent area. This might be due to extra time involved for plan approvals, environmental impact studies, such as in coastal areas, or even restrictions on which contractors are approved to work in a specific area. With less competition in a specific area, contractors can charge more. This often results in higher percentages for profit and overhead. Like kind and quality It is possible that a typical buyer in a real estate transaction would not pay more for a historically significant and costly carved marble fireplace surround imported from France. Nor would he or she pay more for a Ludowici clay tile roof versus a more common brand of similar style and function. However, in the above definition of replacement cost, like kind and quality are important factors. If these items were part of a covered loss, they would be replaced with a fireplace mantel of similar or equal historic significance, and the roof would be replaced with a new Ludowici clay tile roof. Foundation Why should the foundation be included? Masonry products like brick and concrete do not burn like most materials found within a home. However, that does not mean it is fireproof. For example, concrete is made up of numerous components, such as water and aggregate, that can be damaged from rapidly changing, high temperatures, leaving the structural integrity of the concrete compromised. Demolition and debris removal Since our estimates are created based on a total loss scenario, demolition and debris removal costs are included. These costs can vary significantly depending on the age of the home. A newer home constructed of conventional wood framing will often be less costly to remove when compared to an old home constructed of solid masonry. This is because most landfills charge by weight. Also, older homes often run the risk of contamination from things like asbestos and lead-based paint. Both can carry a hefty premium for disposal and may need to be removed individually. There is also a growing trend of landfills not allowing the disposal of burned structures at all because after a fire, the aforementioned contaminates can not be separated. Debris removal can also be impacted by the quantity and type of personal property that was in the home, as electronics and other harmful content could be present. Plans, permits, architectural and engineering fees House plans and engineering studies typically cannot be resubmitted from an old project. Most municipalities will require a new copy with a recent date to help enssure that the documents meet current building codes. It is possible for building permits in affluent areas to cost tens of thousands of dollars or more, as they are typically based on the size and cost of the project. Building code updates When rebuilding older homes, costs can be incurred with common code updates. These may include things like earthquake-resistant design, energy conservation, property line setbacks and wildfire resistance. Another commonly encountered code update in certain municipalities is for fire sprinkler systems. It is possible that a new home or any home undergoing a significant remodel must have a residential fire sprinkler system installed. Logistics In areas with high population density where lots are small, buildings are in close proximity to one another and streets are narrow. The ability to deliver, store and stage materials can be quite challenging. The same principals can be applied to mountain regions or hillside construction. Time Unfortunately, we do not have the luxury of planning when a loss will occur. If we did, goods and services could be ordered well ahead of time so they are delivered as they are needed on the job site. Items like imported flooring, reclaimed beams or cabinetry that is truly custom designed and built specifically for your home can take extra time to plan, build and deliver. It is very common for higher fees to be charged during the reconstruction of a home in order to received goods and services on an expedited basis. Additional considerations High-quality, mass-produced homes are a growing trend in the United States. Builders of these homes have the ability to buy goods and services in bulk, leveraging economies of scale, then pass some of the savings along to the consumer to gain a competitive edge in the marketplace. However, once a development is finished and the large-scale builder moves on to the next project, it won't return to rebuild one home in the event of a loss. This makes every home at the time of loss a custom home. The local home builder that does not have the buying power to leverage such economies of scale will have higher associated costs before ever driving the first nail. For further questions on the matter, please contact our offices. Flooding is a detrimental liability that will cause hundreds to thousands (to possibly tens of thousands!) of dollars in damage if you are not covered. It is important to ensure that you are not only covered, but that you have the proper amount of coverage as well. Since flood insurance policies often do not take effect for 30 days after the policy starts, you should make sure you purchase a policy as soon as you move into a new dwelling. Protect your home and belongings before it's too late!

Each year, thousands of US citizens are placed in a very distressing situation. That scenario arises once their home floods. Flooding will occur due to thunderstorms with excess rain, or the break of a levee. Regardless of the cause of flooding, there are several families who are left to purchase all of the repairs to their home on their own. This is often as a result of several Americans that ought to have flood insurance who don’t. There are many reasons why a home-owner decides to not purchase flood amount of money. One amongst the foremost common reasons for doing this is due to the price. Several people erroneously believe that flood amount of money isn’t definitely worth the value. Sadly, there are several people who would like that they’d purchased the coverage once their home flooded. The price of flood insurance is nothing compared to the price of reconstruction a home. Flooding, additionally called surface water, will come back from a storm or native body of water. Over one-quarter of all flood claims occur in low-risk areas. If your home is in a very high-risk zone the mortgage company will need you to hold flood insurance and it will be big-ticket. If your home is settled in a very low-risk zone the price is extremely cheap and well worthwhile. Flood insurance is provided by the Federal Emergency Management Agency and sold through native insurance agents. If you’re considering casting off flood insurance, keep in mind that there’s a thirty-day waiting amount for brand new policies, that means that from the day you begin the policy there are thirty days before the coverage starts. This is often to keep folks from taking out a policy after they see a storm looming the weather channel. This is why it’s vital to begin your policy as soon as possible. |

Contact Us(817) 479-6358 Archives

August 2023

Categories

All

|

Navigation |

Social Media |

Contact Us

|

RSS Feed

RSS Feed